Depreciation estimate house

This method of calculating the depreciation of an asset assumes that it depreciates uniformly in value over its effective life. Double declining balance is the most widely used declining balance depreciation method which has a depreciation rate that is twice.

Rental Property Depreciation Rules Schedule Recapture

ESTIMATED NET PROCEEDS 269830.

. Desired selling price 302000. Parts of your dwelling like the gutters and furnace are also subject to depreciation. Now lets talk about the structural elements of your home.

According to the IRS the depreciation rate is 3636 each year. Depreciation per year Book value Depreciation rate. This calculator is an estimating tool and does not include all taxes that may be included in your bill.

The investor takes 30000 depreciation each year for ten years. It assumes MM mid month convention and SL straight-line depreciation. It provides a couple different methods.

Ad Calculate Your Houses Estimated Market Value by Comparing the 5 Top Estimates. To use this method the following. Calculate the business use percentage of your home.

What is the depreciation rate for real estate. A house was bought for 200000 in January 2014. The tax assessors value of your property.

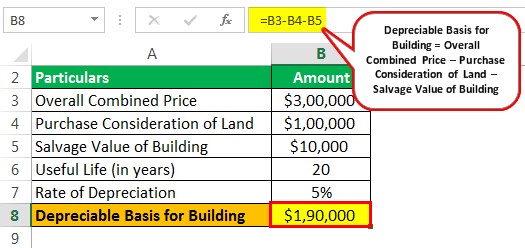

This calculator calculates depreciation by a formula. Use this calculator specifically to calculate depreciation of residential rental or nonresidential real property related to IRS form 4562 lines 19 and 20. That means the propertys adjusted cost basis is 200000 the.

This could be listed on your tax. However if you only use a portion of the. The IRS also allows calculation of.

The recovery period varies as per the method of computing depreciation. Total amount of depreciation taken. In January 2019 it was valued at 250000.

Note that the calculator does NOT project the actual value of any particular house. Select Property Type Construction Type Quality. The FHFA has a house price calculator to estimate home values.

Calculate the average annual percentage rate of appreciation. Instead it projects what a given house. This depreciation calculator is for calculating the depreciation schedule of an asset.

Year 1 Depreciation 3636 Depreciation Percentage 364 Total Depreciation 100000 Final Year Depreciation 1818 Depreciation Amount Cumulative Depreciation Depreciation. Calculate car depreciation by make or model. If the house is only used as a rental property the business use percentage is 100 percent.

For example asphalt roof shingles. A Zestimate is Zillows estimated market value for a home computed using a proprietary formula including public and user-submitted data such as details about a home bedrooms bathrooms. Note that the calculator does NOT project the actual value of any particular house.

Our home sale calculator estimates how much money you will make selling your home. First one can choose the straight line method of. A 250000 P.

An automated valuation model AVM is a computer-driven mathematical model that uses basic property characteristics local market information and price trends to produce a home value. Check with your local homebuilders association or insurance agents to determine your local building costs per square foot and then simply multiply by your homes square footage.

How Is Property Depreciation Calculated Rent Blog

Depreciation And Off The Plan Properties Bmt Insider

How To Calculate Depreciation Expense For Business

Depreciation For Rental Property How To Calculate

Depreciation Of Building Definition Examples How To Calculate

How To Use Rental Property Depreciation To Your Advantage

Tax Calculation Spreadsheet Excel Spreadsheets Spreadsheet Budget Spreadsheet

Straight Line Depreciation Calculator And Definition Retipster

How Remaining Economic Life Works Cleveland Appraisal Blog

Depreciation Of Building Definition Examples How To Calculate

Depreciation Schedule Formula And Calculator

Rental Property Depreciation Rules Schedule Recapture

Appreciation Depreciation Calculator Salecalc Com

A Guide To Property Depreciation And How Much You Can Save

Depreciation Schedule Template For Straight Line And Declining Balance

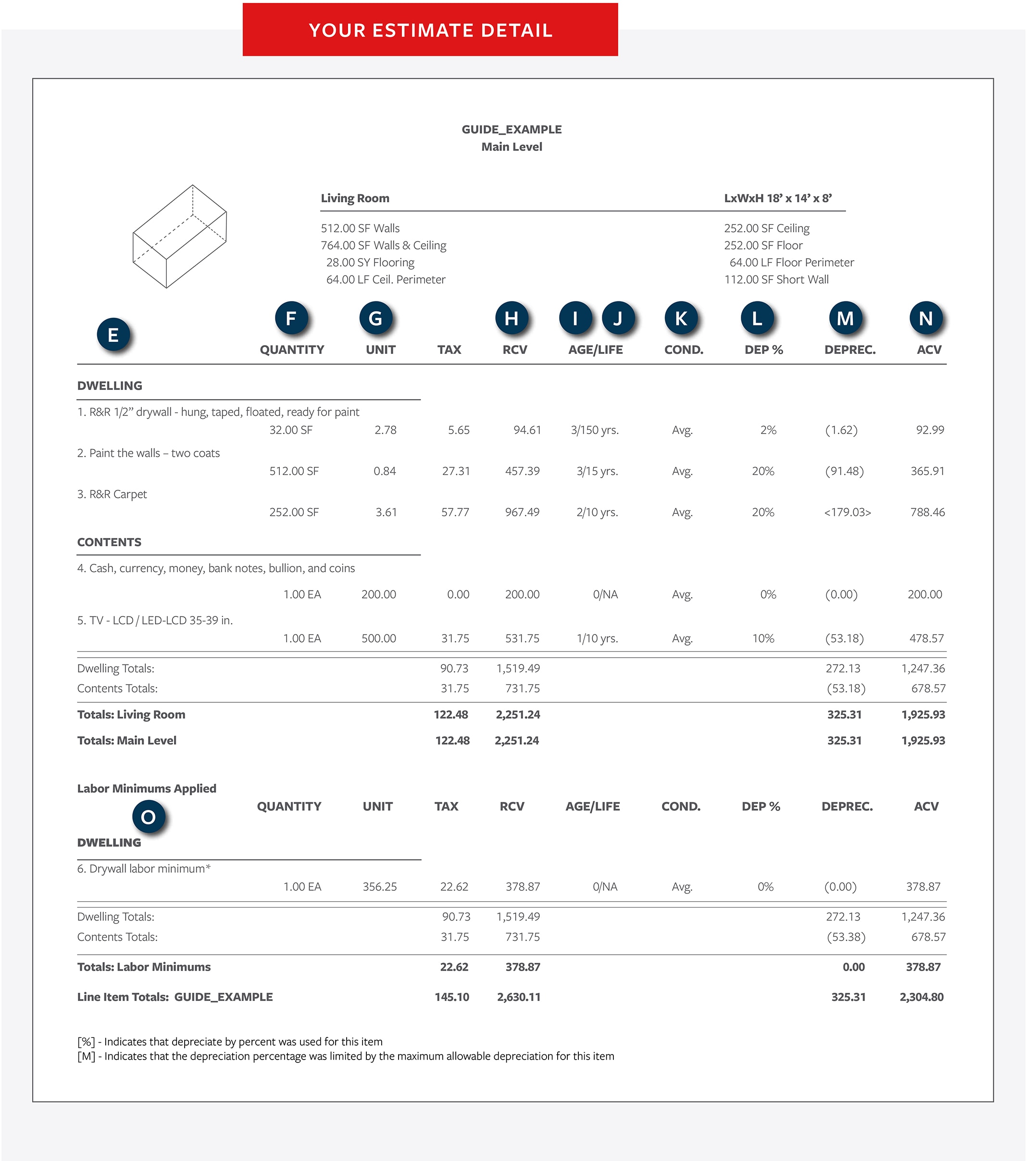

Understanding Your Property Estimate Travelers Insurance

Free Construction Cost Calculator Duo Tax Quantity Surveyors